The Private Equity healthcare sector was dealt a “double-whammy” by the appearance and endurance of the COVID pandemic: just as practice valuations had been soaring to arguably overvalued levels in deals done leading up to March 2020, COVID came and wiped out much of the expected near-term revenue of those practices.

In a further irony, the “darlings” of skyrocketing valuations leading into March 2020 had been subspecialties, and those types of platforms were among the hardest hit (due in large part to their dependence on elective procedures).

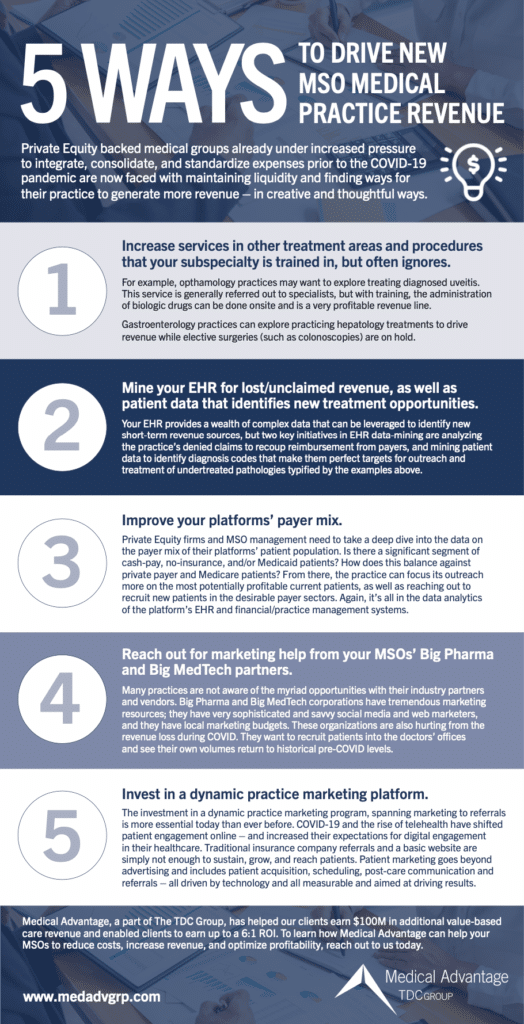

Private Equity backed groups were already burdened with integration, consolidation, and standardization expenses (all normal aspects of business), which was putting pressure on EBITA (earnings before interest, taxes, and amortization). That pressure, coupled with the need for revenue growth to increase their multiples for an eventual exit, COVID-19 changed the daily management calls from driving business to maintaining liquidity.

So, for Private Equity firms and their MSOs, one immediate challenge – and necessity – becomes finding ways for their practices to generate more revenue, often in creative and thoughtful ways that were overlooked before.

Some key opportunities for immediate MSO platform revenue growth include:

1. Increase services in other treatment areas and procedures that your subspecialty is trained in, but often ignores.

One classic example is gastroenterology, a subspecialty in which colonoscopy screening had grown to represent almost 70% of billings in some platforms. COVID and state regulations shut that down (as an elective surgery) before and may do so again in the 2nd wave of COVID this fall. Meanwhile, many gastroenterologists are trained in hepatology (to treat pathologies of the liver, gall bladder, and pancreas), nutrition, and other areas – including the humble hemorrhoids, which are often diagnosed but seldom treated. Such avenues for revenue should now be explored.

Another example is in ophthalmology, where these practices often shy away from treating diagnosed uveitis (a common form of eye inflammation with very specialized treatment); often, ophthalmology practices refer these cases off to further specialists. But, the primary treatment involves infusion biologics and setting up an infusion room in the practice is very low-capital; it would involve using physical space and the training to administer the biologic drugs – and it’s a very profitable revenue line.

2. Mine your EHR for lost/unclaimed revenue, as well as patient data that identifies new treatment opportunities.

We can only scratch the surface here on the deep and complex wealth of data in a practice’s EHR that can be leveraged to identify new short-term revenue sources. But two key initiatives in EHR data-mining are analyzing the practice’s denied claims (many of which can be easily re-worked to recoup reimbursement from payers that goes straight to the bottom line), and mining patient data to identify diagnosis codes that make them perfect targets for outreach and treatment of undertreated pathologies typified by the examples above.

3. Improve your platforms’ payer mix.

Private Equity firms and MSO management need to take a deep dive into the data on the payer mix of their platforms’ patient population. Is there a significant segment of cash-pay, no-insurance, and/or Medicaid patients? How does this balance against private payer and Medicare patients? From there, the practice can focus its outreach more on the most potentially profitable current patients, as well as reaching out to recruit new patients in the desirable payer sectors. Again, it’s all in the data analytics of the platform’s EHR and financial/practice management systems.

4. Reach out for marketing help from your MSOs’ Big Pharma and Big MedTech partners.

Many practices are not aware of the myriad opportunities with their industry partners and vendors. Big Pharma and Big MedTech corporations have tremendous marketing resources; they have very sophisticated and savvy social media and web marketers, and they have local marketing budgets. These organizations are also hurting from the revenue loss during COVID. They want to recruit patients into the doctors’ offices, and see their own volumes return to historical pre-COVID levels.

Private Equity firms and larger MSOs are well-positioned to reach out to these industry players for mutually beneficial marketing and patient recruitment help at the local/regional market level.

5. Invest in a dynamic practice marketing platform.

Historically private practice physicians have made slow progress towards becoming marketing organizations. Rightfully so, physicians first and foremost mission was delivering quality patient care. As groups grow, quality care is still the number one driver – however without new patients, or the right patient mix, quality care is just a mission statement.

The investment in a dynamic practice marketing program, spanning marketing to referrals is more essential today than ever before. COVID-19 and the rise of telehealth have shifted patient engagement online – and increased their expectations for digital engagement in their healthcare. Traditional insurance company referrals and a basic website are simply not enough to sustain, grow and reach patients. Patient marketing goes beyond advertising and includes patient acquisition, scheduling, post-care communication and referrals – all driven by technology and all measurable and aimed at driving results.

Finding and driving new revenue sources at the practice level is more critical than ever before; despite truly impressive adaptation in the wake of COVID’s first wave, this fall may knock all of us back again with a 2nd wave. Fortunately, Medical Advantage is a consulting partner that can help, with our Private Equity, Data Analytics, Performance Dashboards, EHR Optimization, Revenue Cycle Management, and Practice Transformation teams.

Medical Advantage, a part of The TDC Group, has helped our clients earn $100M in additional value-based care revenue and enabled clients to earn up to a 6:1 ROI. Our Private Equity team assists PE Firms, MSOs, and Physician Practices and Platforms in improving workflow efficiency, standardizing and optimizing EHR technology, increasing payer reimbursement and quality bonuses, and other services. We are part of a $6B national enterprise serving over 1000,000 physicians and healthcare-related entities. To learn how Medical Advantage can help your MSOs to reduce costs, increase revenues, and optimize profitability, reach out to us today.