Whether you are looking to make the most of potential incentives or simply to avoid costly penalties, understanding the guidelines for MIPS (CMS’ Merit-based Incentive Payment System) is key. With MIPS reporting requirements changing and growing more complex all the time, identifying and avoiding common MIPS mistakes is key to success.

Understanding MIPS scoring requirements is a good place to start. For the 2021 reporting period, the Performance Threshold (PT) is increasing from 45 to 60 points, meaning you must score at least 60 points just to avoid a penalty. In 2022, that number will climb even higher – with 74 points becoming the minimum score to avoid penalization.

Conversely, if you are looking to maximize your incentive in 2021, any clinician who exceeds the exceptional performer threshold or (EPT) of 85 points will be entitled to a bonus from a $500 million pot. 2022 will be the last year to capitalize on this exceptional performer threshold bonus.

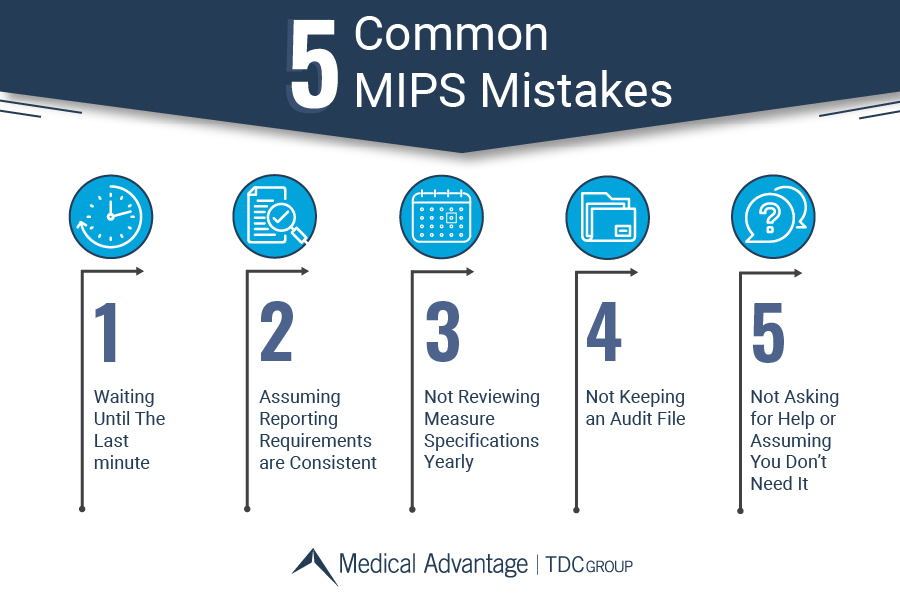

Whether you’re looking to avoid a penalty or maximize your incentive, here are 5 common MIPS mistakes – and how to avoid them.

1. Waiting Until The Last minute

The most common mistake we see clinicians make is waiting until the last minute. Some practices may wait to report since some EHRs have been known to implement reporting or specifications changes as late as the third quarter. Despite this, there are steps you can take in the meantime. Reach out to your EHR and ask if they have updated workflows to capture the data for the measures you’re reporting on. Once your reports are available, be sure to monitor them monthly from the time they become available and drill into which patients you are missing, and why. You may find that your measures may be topped out or deleted, your EHR may not be capturing the data where you’re entering it, or you may need to educate your staff on the appropriate workflows to capture this data.

2. Assuming Reporting Requirements are Consistent

Although MIPS is a consolidation of various legacy reporting programs (Meaningful Use, PQRS, VBR), it is important to understand that program requirements are continually-evolving, and are updated by CMS each year in the QPP Final Rule. This document is thousands of pages long, and you can almost guarantee that some of these changes will affect your practice. Some notable changes in the past impacting your requirement to report or not have included: updated low volume thresholds, changes to eligible clinician types, and responses to public emergencies such as COVID-19.

Listen to our MIPS 2021 Updates Webinar

3. Not Reviewing Measure Specifications Yearly

Measure Specifications are subject to annual change during the Final Rule that is published at the end of each reporting year. Your measures from last year may have had substantive modifications or changes for the following reporting year. These modifications may impact numerator/denominator criteria, measure exclusions, and even coding specifications. If these changes are substantive enough, CMS may even remove the benchmark for that measure. For example, a common measure that has been around for years that does not have a benchmark for 2021 due to recent changes is measure #226: Preventive Care and Screening: Tobacco Use: Screening and Cessation Intervention. Be sure to review measure specifications yearly to keep ahead of changes and ensure your organization is reporting properly.

Search for measure yearly specifications here

4. Not Keeping an Audit File

Although our world is largely digitized, it is imperative to keep an accessible copy of your MIPS Documentation. Each reporting year should have a corresponding MIPS Audit File easily accessible and known to you and your support staff. If you have recently acquired the responsibility of reporting MIPS for your practice, then you understand how important this is for those who follow in your footsteps. Not to mention – if you are indeed audited, it will be two years after the corresponding reporting year, and many aspects of your practice may have changed by that point, including the person responsible for reporting or your EHR and computer/software systems. Failure to keep the required records on hand and accessible could result in failing an audit and having MIPS incentive money retracted.

Read more about MIPS Data Validation and Audit (DVA)

5. Not Asking for Help or Assuming You Don’t Need It

MIPS is ever-evolving. Handling reporting and operating the workflows necessary to succeed under MIPS can represent an incredible challenge for even the savviest healthcare professionals. There are endless resources available to you on the QPP Website, but even then the reporting burden can be overwhelming — on top of the numerous day-to-day responsibilities care providers already have. Some practices even assume that their billing company “takes care of it” for them – a common misconception, and a crucial mistake.

Learn more about how about our MACRA Consultants can help

Medical Advantage can Help Fix These Common MIPS Mistakes

With MACRA constantly changing from year-to-year, it can be challenging for practices to keep up. Now is a great time to consider engaging the help of experts like Medical Advantage’s MIPS Consultants. Our MIPS consultants have years of experience working as practice managers, nurses, and billing specialists. With our full-time focus and devotion to this program, we can offer insights to help your practice succeed in MACRA for 2021 and beyond. Since 2017, we’ve helped thousands of clinicians exceed the national average in MIPS scores, with 99% achieving exceptional performer status for maximum reimbursement. Get in touch today for a free consultation to find out how our services can support your practice.